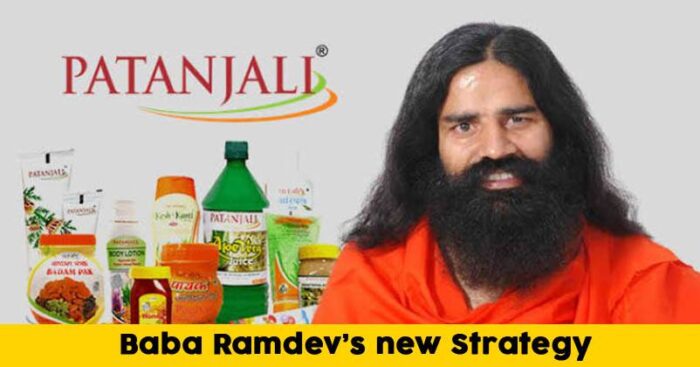

Last year was a difficult year for many corporations and businesses in India. Moreover, 2019 isn’t at a better place considering companies like Jet Airways and Aircel. So was the case for Patanjali, working under Ramdev Baba’s leadership for a while now and growing at substantial high rates, thanks to its distribution network, which fell short last year.

What went wrong?

Patanjali had made its dream known to the world since the very start – To be the top market player in the FMCG industry starting from its ayurvedic product range.

However, last year, the company came to a standstill. Patanjali’s turnover stayed static at Rs 10000 crores, half of its target of Rs 20000 crores. Moreover, this also left a great impact on their future targets and other plans.

The tough competition!

The companies vast spreading network of products was impacting its core business of ayurvedic products. Moreover, it started facing stiff competition from other FMCG brands which started rolling out their own ayurvedic products. Distribution started becoming an issue due to the expansion and system of operations. For, all of these reasons, Ramdev baba’s Dream was losing light.

What has changed things recently?

Ruchi Soya, a company that was filed for insolvency, considering huge debts and due loan payments, initiated by DBS Bank and Standard Chartered Bank was purchased by Patanjali in a RS 4325 crore bid. Not only will this help Patanjali be a major seller in the Soyabean oil market in India, but allow it to have a hold over products like Ruchi star, Ruchi gold, Nutrela, and Sunrich. Also, Ruchi Soya with a 3.72 million MT has the largest oilseed extraction capacity in India and it’s under Patanjali now.

Moreover, this move will allow Patanjali to move one step closer to its goal of leading the Vegetable oil market of the nation which would grow by an expected rate of 3% annually. Vegetable oil sales are forecasted to exceed 34 tonnes by 2030 and Patanjali plans to produce most of that amount.

Ruchi Soya: The Saviour

The company which has a near 14% share in India’s vegetable oil market had a RS 9345 crore debt to various creditors. State Bank of India (SBI) should be receiving RS 1800 crores from Ruchi Soya. Other creditors include Central bank ( RS 816 crores), PNB ( RS 743 crore) and Standard Chartered ( RS 608 crore). The last straw for this Haridwar based company was filing for insolvency in 2017, sent by NCLT. In August 2018, the highest bidder was Patanjali followed by Adani Wilmar. Patanjali had initially offered RS 5765 crores out of which Rs 4065 crores was supposed to go to a bank.

The struggling journey of Ruchi Soya and it’s downfall worked in favor of Patanjali. Hopefully, this would increase its turnover and bring it back to the higher ground.