Yes, we all know that in most banks, when we open an account, we are required to maintain a monthly minimum balance, but do we know that not maintaining this balance and sometimes that deduction of a small fees towards non- maintenance of balance has this year added more than 5000 crores in the banks kitties.

This amount has gone up despite the fact that banks opening some 30.8 crore basic savings accounts under the Jan Dhan Yojana for those who can’t afford to maintain a minimum balance.

How much did the banks earn?

The State Bank of India (SBI), alone, in the fiscal year of 2017-18, collected Rs 2433.67 crores from its customers, all against non-maintenance of the required minimum balance, the Firstpost reported.

HDFC bank has charged Rs 590 crores for the same reason, which was the largest of the three private banks (Axis, HDFC, ICICI). The highlight point here was the fact that these top 3 private banks account for about 40% of the total amount collected across private and public sector banks.

Fines Structure.

Also Read: The Story Behind State Bank Of India Logo

How much do banks charge?

For example, a basic HDFC or ICICI bank account requires the account holder to maintain a minimum balance of Rs 10000 in urban sectors and Rs 5000 in rural sectors. A fee between Rs 150-Rs 600 + GST is levied in urban and Rs 270 to Rs 450 + GST in the rural areas.

On the other hand, SBI categorizes its branches into different types and accordingly sets norms for minimum balance and fines charged.

Urban and Metro Branch:

Required Minimum Balance per month- Rs 3,000

Fines levied range between Rs 10-Rs 15

Semi-Urban Branch:

Required Minimum Balance per month- Rs 2,000

Fines levied range between Rs 7- Rs 12

Rural Branch:

Required Minimum Balance per month- Rs 1,000

Fines levied range between Rs 5- Rs 12

The accounts exempt from the above fines are namely: Jan Dhan accounts, No-frills accounts, salary accounts, Pehla Kadam Pehli Udaan accounts, and all the pension accounts.

Expert’s View

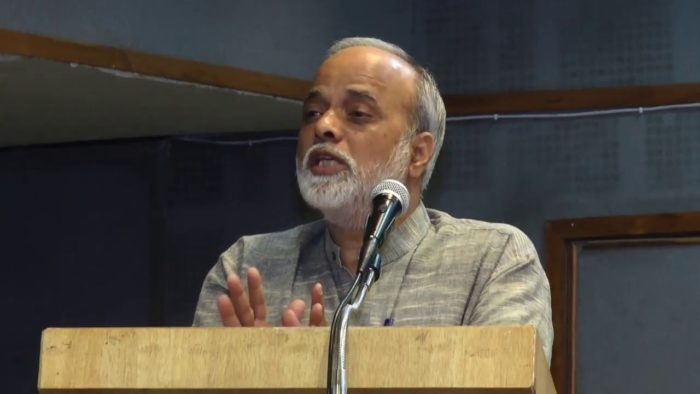

The Firstpost talked to Devidas Tuljapurkar, Joint Secretary of the All India Employees Bank Association, who explicitly put the blame on the rising Non-Performing-Assets (NPAs) which as on March 31st, 2018, were at Rs 8,45,475 crore rising from Rs 2,16,739 crore as on March 31st, 2014 (as revealed by the MOS Finance in the Lok Sabha) and said that the fines were being charged as part of a recovery by banks.

He was quoted as, “On the one hand, the government says it wants more people to get into the formal banking system. On the other, banks discourage them by charging for not maintaining a certain balance. This is nothing but a cascading effect of rising bad loans.”

Also, to add, the SBI reported a loss of Rs 7,718 crores in the fourth quarter of 2017-18 and the reason attributed are the growing NPAs, which increased from 6.9% of the total loans in 2016-17 to 10.91% of the total loans in 2017-18, Firstpost stated.

Furthermore, he said, “The Rs 11,500 crores are obviously recovered from customers who belong to the salaried, lower middle class. Who would struggle to maintain the minimum balance? Certainly not the rich and elite.”

So much did you add this year to your bank’s income?