The year 2021 brought with it a massive surge in the number of unicorn startups globally. This phenomenon also paved way for many companies to go public. Trillions of venture capital dollars were spent on startups over the past decade.

According to Ernst & Young, a record 2,388 firms raised $453 billion while going public in 2021—the highest annual deal volume ever.

Many market experts believe that this trend is likely to increase in the year 2022 as well. As per the list shared by Forbes, the IPO market is bracing for yet another massive year, but it’s unclear whether it will result in a boom or bust.

Here are the companies that are likely to launch their IPOs in the year 2022.

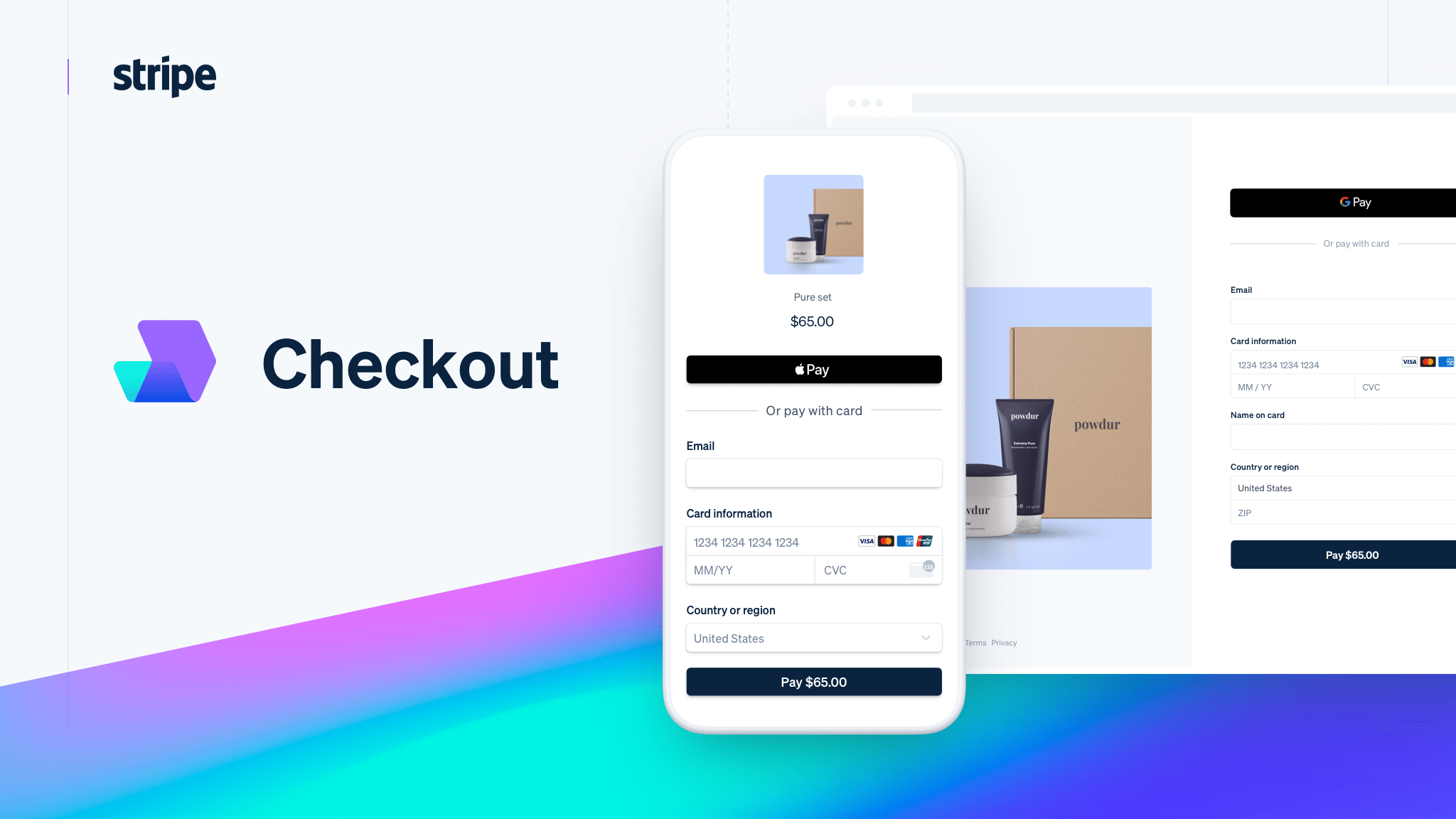

Stripe

Stripe Inc. is a financial service and software as a service company that primarily offers payment processing software and application programming interfaces for e-commerce websites and mobile applications.

Total Valuation: $95 billion

Instacart

Instacart operates a grocery delivery and pick-up service in the United States and Canada. The service allows customers to order groceries from participating retailers with the shopping being done by a personal shopper.

Total Valuation: $39 billion

Chime

Chime Financial, Inc. is an American financial technology company that provides fee-free mobile banking services provided and owned by The Bancorp Bank or Central National Bank.

Total Valuation: $25 billion

Discord

Discord is a VoIP, instant messaging, and digital distribution platform. Users communicate with voice calls, video calls, text messaging, media, and files in private chats or as part of communities called “servers”.

Total Valuation: $15 billion

Reddit is an American social news aggregation, web content rating, and discussion website. Registered members submit content to the site such as links, text posts, images, and videos, which are then voted up or down by other members.

Total Valuation: $10 billion

Impossible Foods

Impossible Foods Inc. is a company that develops plant-based substitutes for meat products.

Total Valuation: $4 billion

Trump Media & Technology Group

Trump Media & Technology Group is a media and technology company founded in February 2021 by former US President Donald Trump.

Total Valuation: $2 billion

TPG

TPG Capital is focused on leveraged buyouts and growth capital. TPG manages investment funds in growth capital, venture capital, public equity, and debt investments.

Assets Under Management: $109 billion