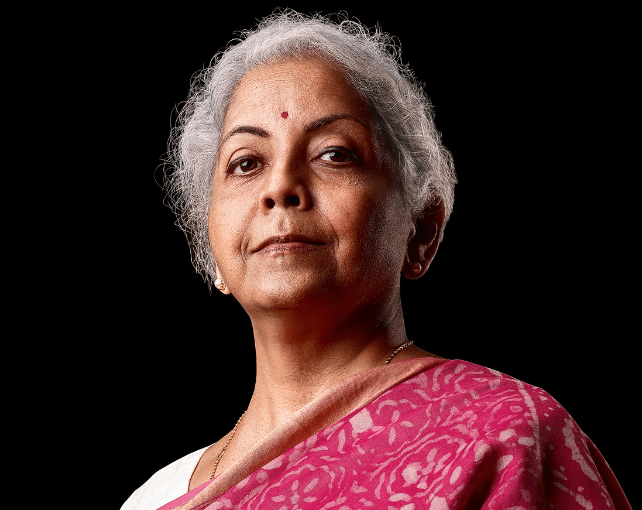

Key Points of the Union Budget 2023: On February 1, Nirmala Sitharaman, Finance Minister unveiled the Union Budget 2023–24, which placed more of an emphasis on infrastructure development, social sector programs, and the middle class.

Highlights of the 2023 budget: The Modi administration’s goals include the construction of roads, motorways, and railway lines, as seen by the Budget for 2023–24’s continued emphasis on increasing Capex. With adjustments to the new income tax system, the middle class has received some relief, making it quite evident that the government intends to switch from the old system to the new one. The FM adhered to the budget deficit path outlined in the Budget, setting a goal of 5.9% for FY 24 and maintaining the objective for the current fiscal year.

Here are the budget’s main highlights for 2023:

Important updates for income tax filers:

1. The previous tax system has not changed.

2. A new tax system will take over as the default tax system.

3. Under the new tax system, income up to Rs 7 lakh is not subject to tax.

4. In the new tax system, the government proposes raising the income tax refund threshold from Rs. 5 lakhs to Rs. 7 lakhs.

5. Government plans to lower the highest surcharge rate in the new tax system from 37% to 25%.

New tax systems, New Slabs

Rs 0-3 lakhs – Nil

Rs 3-6 lakhs – 5%

Rs 6-9 lakhs – 10%

Rs 9-12 lakhs – 15%

Rs 12-15 lakhs – 20%

Rs Over 15 lakhs – 30%

*The regulation states a limit of Rs. 10 crores for capital gains tax deductions on investments in (existing) residential properties.

*Only Rs. 45,000 in taxes must be paid by a person making Rs. 9 lahk per year: Sitharaman, FM

*According to the new tax code, a person making Rs 15 lakh would only be required to pay Rs 1.5 lakh in taxes instead of Rs 1.87 lakh.

*The new tax system reduces the amount of tax that a person earning Rs 15 lakh must pay between Rs 1.87 lakh to Rs 1.5 lakh: FM

* Agniveer Corpus Fund payments received by Agniveers would be exempt

* Agniveer Corpus Fund payments received by Agniveers would be exempt

*Fully imported luxury automobiles and EVs would cost more since the government increased customs duty in the budget from 60% to 70%. Tax-free leave encashment for non-government paid workers has increased from Rs 3 lakh to Rs 25 lakh.

Indirect Taxes:

*Certain cigarettes will be subject to a 16% tax increase,

* Glycerine’s basic customs tax was cut to 2.5 percent.

* Silver import taxes increased to match those of gold and platinum

* Extend the reduction in customs duties on imports of mobile phone parts by one year

*Customs duty on open TV panel cells has been cut to 2.5% to encourage TV production.

*Certain components and inputs, such as camera lenses, are exempt from customs duties.

* An additional year of tax concessions tariff on lithium-ion batteries

Announcements about savings plans:

* The Senior Citizen Savings Scheme’s maximum deposit limit will increase from Rs. 15 lakh to Rs. 30 lakh

* The ceiling for the Monthly Income Scheme will double to Rs. 9 lakh and Rs. 15 lakh for joint accounts.

*Mahila Samman Saving Certificate, a one-time new saving programme for women, will be made available for 2 years, through 2025.

Railways receive massive boost:

* The railways received an expenditure of Rs 2.4 lakh crore in FY24. *It is about nine times more than the allocations for FY14 and is the largest allocation for Railways ever.

Capex increased 33%.

* According to FM, capital expenditure climbed by 33% to Rs 10 lakh crore, or 3.3% of GDP.

* The center would effectively spend Rs 13.7 lakh crore in capital.

* Capital expenditures will account for 3.3% of GDP in FY24.

* The Center’s effective capital expenditure for FY24 was Rs 13.7 lakh.

Financial standing:

* The government aims to reduce the budget deficit to 4.5% of GDP by 2025–2026.

* The revised estimate’s 6.4% fiscal deficit forecast for FY23 has been dropped to 5.9% for FY24.

* In FY24, gross market borrowing was estimated at Rs 15.43 trillion.

* Net market borrowing is expected to be Rs 11.8 lakh crore in FY24.

* The revised projection for FY23 net tax collections is Rs 20.9 lakh crore.

* The estimated total expenditure for FY23 is Rs. 41.9 lakh crore.

* The FY23 total revenue forecast has been revised to Rs 24.3 lakh crore.

* Net tax collections for FY24 were Rs 23.3 trillion.

MSME

* A revised loan guarantee for MSMEs will go into effect on April 1, 2023, and a corpus of Rs 9,000 crore will be added.

* A new credit guarantee programme for MSMEs will lower borrowing costs by 1%.

Banking:

*To strengthen bank governance, the government has proposed changes to the Banking Regulation Act.

Skill development

* Pradhan Mantri Kaushal Vikas Yojana will be introduced by the government. 4.0

* Thirty Skill India International Centers will be built throughout various States to prepare young people for possibilities abroad.

Clean Energy:

* Priority funding for the energy transformation of Rs 35,000 crores

* Under the Environmental Protection Act, a green credit programme will be announced.

* Viability gap financing for battery storage.

* The government will subsidize the installation of a 4,000 MwH battery system.

* The National Green Hydrogen Mission, with a budget of Rs 19,700 crore, aims to establish the nation as a market and technological leader while easing the transformation of the economy to one with a low carbon intensity.

Jewelery and gemstones

* One of the IITs will get five-year research and development funding to promote domestic manufacturing of lab-grown diamonds.

* Part-B of the Budget paper will contain a proposal to reconsider the customs tax on lab-grown diamonds.

Aviation:

* To increase regional air connection, 50 more heliports, airports, sophisticated landing grounds, and water aero drones will be resurrected.

Business Ease

* The government will introduce Vivad Se Vishwas-2, a new dispute resolution programme, to resolve business conflicts.

*All government agencies’ digital systems will use PAN as their common identity. Aadhaar will serve as the fundamental identity and Digi

locker will serve as a one-stop shop for updating and reconciling identities stored by multiple agencies.

* To facilitate quicker response to business filings under the Companies Act, a central processing center will be established.

*The PAN will serve as standard identification for all Advanced Analytics solutions of the designated government agencies for commercial establishments that are required to have one.

* To make conducting business easier, over 3,400 law provisions have been decriminalized and over 39,000 specifications have been lowered.

* The finance minister unveiled many initiatives to boost business in GIFT City.

Digital services

* DigiLocker’s service offering will grow.

* Engineering colleges will build up 100 laboratories for creating 5G-ready apps.

* Labs will address applications in healthcare, precision agriculture, and smart classrooms.

* The inauguration of Phase 3 of the e-courts project would cost Rs 7,000 crore.

*Leading business actors will collaborate to provide choices that are scalable for the health, agricultural, and other sectors.

Urban Planning

* The government would provide Rs 10,000 billion annually for the fund to the construction of urban infrastructure.

* Cities will be encouraged to increase their ability to repay municipal debts

* Throughout all cities and municipalities, strive towards 100% mechanical biodegradation of septic tanks and sewers.

Housing

* PM Awaas Yojana’s expenditure increased 66% to above Rs 79,000 crore.

Continued interest-free lending to states

* The Center will give state governments a 50-year, interest-free loan for another year.

Setup of a Children’s and Teens’ Digital Library:

* A national digital library for children and teenagers will be established.

* The National Book Trust and Children’s Book Trust will update digital libraries with non-academic works in regional languages and English.

* States should be urged to establish physical library functions for them at the ward and panchayat levels and to provide the necessary infrastructure for them to access the National Digital Library’s materials.

Education

* Three artificial intelligence excellence centers will be established in prestigious educational institutions.

* Alongside the 157 medical colleges that have already been operating since 2014, 157 new graduate nurse colleges will also be created.

* Residential schools modeled like Eklavaya will be built within the following three years. 38,800 lecturers and support staff will be hired by the Center to work in 740 schools that will serve 3.5 lahks, tribal kids.

Agriculture

* Agri – startups by aspiring entrepreneurs will be supported by an Agriculture Accelerator Fund, which will be established.

The development of digital public infrastructure for the agricultural industry The amount of agricultural finance that must be provided would be raised to Rs 20 lakh crores, with an emphasis on the dairy, fishery, and animal husbandry.

* One crore farmers would receive support to switch to natural farming during the next three years.

* There will be 10,000 bio-input service stations established.

Fisheries

*launching a sub-scheme under the PM Mastya Sampada Yojna with a budget of Rs. 6,000 crores in order to better facilitate fishermen’s operations.

*Indian Institute of Millet Research will receive assistance as an excellence center.

* With a $2.516 billion investment, 63,000 main agricultural credit organizations have started the computerization process, according to FM

*In Karnataka’s central areas, which are prone to drought, the upper Badra project would get central aid of Rs. 5,300 crores to ensure sustainable micro-irrigation.

The welfare of Tribes

* To enhance the socioeconomic situation of PMPVTGS, the “Pradhan Mantri Primitive Vulnerable Tribal Group (PMPVTGS) mission” has been initiated.

* A PMPBTG Development mission will be initiated to saturate PBTG habitations with basic facilities to ameliorate the social-economic situation of the Particularly Tribal Groups. In the next three years, Rs 15,000 Cr would be made accessible to implement the plan.

Following are the seven top Budget priorities:

1. Integrated development

2. Completing the final mile.

3. Investment and infrastructure.

4. Opening up the possibility.

5. Green expansion

6. Youth force

7. Financial industry.

Goals of the Budget for 2023 will be:

1. Providing residents with numerous chances, especially young people

2. giving a powerful boost to GDP and employment creation

3. Enhancing macroeconomic stability

4. To include a goal for women’s emancipation in Budget 2023

5. To help women’s self-help organisations advance to the next level of economic empowerment

6. To assist self-help organisations with product branding, marketing, and raw material supply

Goals of the Budget for 2023 will be:

1. Providing residents with numerous chances, especially young people

2. giving a powerful boost to GDP and employment creation

3. Enhancing macroeconomic stability

4. To include a goal for women’s emancipation in Budget 2023

5. To help women’s self-help organisations advance to the next level of economic empowerment

6. To assist self-help organisations with product branding, marketing, and raw material supply

Tourism:

*States will actively participate in the mission to promote tourism, which will bring together government initiatives and public-private partnerships.

* Through the challenge mode, 50 tourist spots will be chosen, and they will be created as a complete package for both local and international tourists.

* States will be urged to establish a “Unity Mall” in their state capital or the busiest tourist attraction to promote and sell “One District, One Product” items as well as GI goods and other handicrafts.

* The nation has a lot to offer both local and international visitors. The tourist industry has a lot of untapped potential. For young people in particular, the industry offers tremendous job and entrepreneurial opportunity.

PM Vishwa Karma Kaushal Samman

* “The PM Vishwa Karma Kaushal Samman-package” of help for traditional craftsmen has been conceptualised; it will allow them to increase the quality, scale, and reach of their products while integrating into the MSME value chain.

Free food programme will run till 2024:

* We’re developing a programme to provide “free food grain to all Antyodaya and priority households for one year under PM Garib Kalyan” starting on January 1, 2023, as part of our ongoing commitment to food security. Yojana Ann

* We implemented a programme to provide free foodgrains to more than 80 crore people for 28 months during the COVID epidemic to ensure that no one ever goes to bed hungry.

* A knowledge-based, technology-driven economy with sound government finances and a thriving financial sector is part of our ambition for the Amrit Kaal. It is crucial to attain this “janbhagidari” by “sabka saath, sabka prayaas,” FM stated.

* A number of achievements, including Aadhaar, Cowin, and UPI, have helped to raise India’s standing internationally. No one ever was going to bed hungry during the epidemic, according to Finance Minister

* Since 2014, government initiatives have guaranteed that all residents live better, more dignified lives. To Rs 1.97 lakh, the per income per capita has more than doubled. India’s economy has grown in size during the past nine years, moving up from tenth to fifth place.

* The number of EPFO members has doubled, reflecting the economy’s increased formalisation.

* According to Finance Minister Niramala Sitharaman, this is Amritkall’s first budget.

* The Indian economy is moving in the right direction and has a promising future. In the past nine years, India’s economy has grown from being the 10th to the 5th biggest.

* Despite the significant worldwide slowdown brought on by the epidemic and the war, the world has recognised India as a shining light; our growth for the current year is anticipated at 7%, making it the greatest among all major economies.