While business groups/houses who have a stronghold in the dispensable finance and consumer business’ market, are witnessing the so promised “Ache Din” by the NDA government, there are a host of other business groups (including some Giants) who are into manufacturing segments such as power, metals, telecom, and capital goods, and didn’t get the chance of knowing what the phrase referred to.

Pros of The Modi Government..

The last five years under the leadership of Prime Minister Narendra Modi had been benefitting for businesses like the Bajaj Group. This company, led by a member of the Bajaj family itself, happens to be topping the list when we talk about the beneficiaries of the Modi tenure in the Centre. Mukesh Ambani led Reliance, Ashok Mansukhani led The Hinduja, Gautam Adani led the Adani Group are some of those business groups who had been very recently observed a hike in their profits and market capitalization and thus were included in the above-mentioned list ( after the Rahul Bajaj led The Bajaj Group).

The benefit for the consumers

People say that this growth in the market capitalization of these companies is the results of ever-growing demand of their consumers. But there’s something more to it. Prime Minister Narendra Modi decided to follow suit and give voters an enhanced purchasing power, a few weeks before the elections 2019.

This move from the PMO’s end proves out to be beneficial for consumer finance companies like Bajaj Finance Ltd and ofcourse for the consumer business companies like Reliance. Bajaj Group, including Bajaj Finance and Bajaj Finserv, experienced a four times enhancement (4.08 trillion in 2019 as compared to 1 trillion in 2014) in their market capitalization. This growth was calculated to be at a rate of 32.4 % per annum.

Cons for a few..

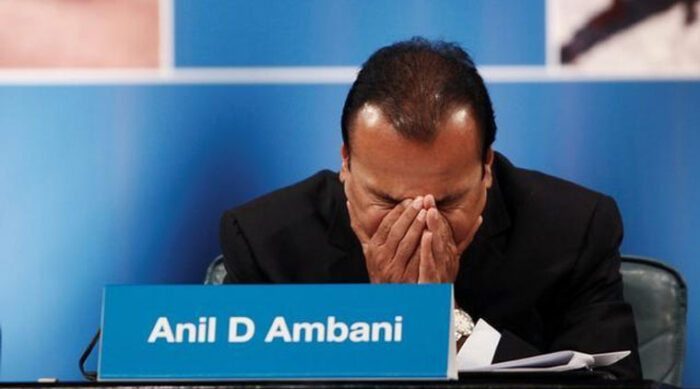

After having talked about these companies in details, it’s time to take into account the companies whose market capital share saw a downward graph in the past five years. Anil Ambani, Navin Jindal, Dilip Sanghvi are the ones who have been continuously struggling to earn the maximum possible earning from their respective companies.

But Alas! None could save his company from these demoralizing financial results. The financial reports of these companies are so poor that they indicate pretty low annual returns, trooping down to even a single digit annual return as well. To throw some light on the statistics, it is worth appreciating to know that Anil Ambani Groups collectively lost about 85 % of the market capitalization, which is as far the maximum loss for any company under this Government’s jurisdiction.

Thus it can be said that the Modi Wave that promised “Ache Din” for all, could not justify their stance with a proper reason and thus only one out of every three company could utilize the opportunities given to it by the Prime Minister. Appreciating the fact that consumers are the kings, the shifting of the focus of the government towards the appraisal of the consumer companies and dispensable lenders is also one of the major reasons of growth of this industry.