Currently, India has an unemployment gap of 7.12%. This comes even after there is a new startup being added to the list every hour. So far, the country has had more than 7 lakh job openings due to the boost of startups since 2016. But what goes beyond establishing a startup and hiring talents?

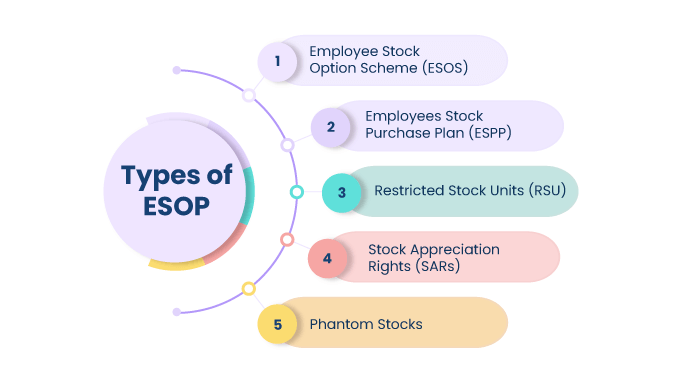

The true mark of a company is how they utilise their hirings and sustain talents for the long run. For this, policies need to be adopted for the welfare of the company and its employees. Employee stock options or ESOPs have come into play that is being implemented by a few startups. These are given as bonuses or rewards year-round based on performance.

Can ESOPs boost wealth for Startups?

Based on the duration of an employee’s tenure in the company, ESOPs are stocks allocated to them as a reward. Since the world is investing in stocks, these ESOPs ensure that employees are being mindful of their investing habits as well.

With the option of holding stakes, companies are promoting wealth by depending on the bond between them and their employees. This Employee Stock Option was recognised by the Indian Companies Act in 2013.

Startups might have a boost in wealth or go through some cash constraints depending on the economical situation. Here, ESOPs for employees help in bridging that gap. Any employee willing to sell back to the company can look at lucrative buy-back options as well.

How do ESOPs Affect Taxes?

Taxation on ESOPs comes into effect only on the benefits accrued by an employee through the shares. If the total value of the stock is Rs. 5000 and a company decides to give shares of the same to its employees as Rs. 10 per share. the startup would be liable to be taxed at Rs. 4990.

Also Read: Four Ways By Which Startups Can Help Tackle Employee Burnout

Startups also have the option to be exempted from taxes on shares under Section 80-IAC of the Income Tax, 1961.

Does your company have an ESOP policy as well?