An analyst at Jefferies India Pvt. Ltd has stated that Mamaearth, which is run by Honasa Consumer, currently has an annual revenue run rate of more than ₹700 crores ($100 million).

The brokerage agency’s analysts have studied the explanations behind Mamaearth’s outstanding development in just 5 years of commencement.

In a report released on 12 April, Jefferies’ analysts said, “From a meager income base of Rs17 crore in monetary yr 2019, Honasa Shopper has seen a meteoric rise with monetary yr 2021 revenues at about ₹500 crores. The base portfolio has grown properly and new launches have additionally contributed.”

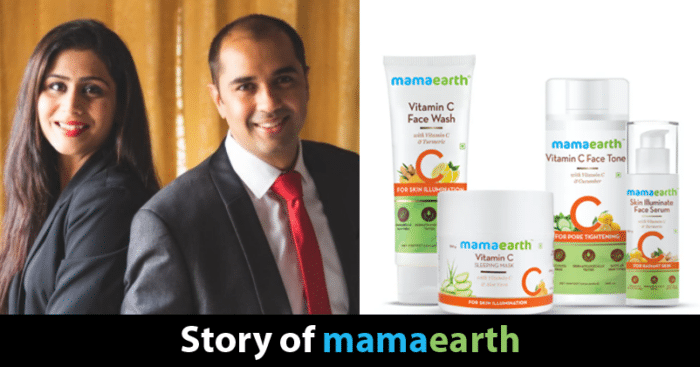

How Mamaearth Came To Be?

Mamaearth was founded by a couple, Ghazal Alagh and Varun Alagh, who were struggling with finding the right products for their child. Like any vigilant parent, the couple researched well about the baby products available in the market before buying them. To their surprise, most baby products, be it lotion or shampoo contained toxins that have proven to be harmful.

Worried not just for their own child but for all the little ones out there, the couple decided to do something about it & create products that were completely safe & certified toxin-free. That is how Mamaearth came to be in 2016.

What Lead To Its Growth & Sucess?

The brand has been awarded as Asia’s first personal care brand with MadeSafe certified, toxin-free products for mothers and children and is backed by Sequoia India, Fireside, Stellaris, Titan Capital, and Bollywood actress and entrepreneur Shilpa Shetty.

Expanding Product Range

Over the years, the brand has expanded its product range from baby care products into other fields, particularly in hair care and skin care. As per the report, of all Mamaearth’s model revenues, 20% comes from the baby products range while the rest 80% comes from the skin and haircare range.

Its revenues derive mainly from its personal D2C platform, e-commerce channels, and offline sources.

Market Placement & Advertising

Apart from expanding its target market, another reason behind corporate’s rise in such a short span of time is its ‘robust model positioning, product innovation, advertising excellence, and increasing retail attain and distribution’ as per Jefferies.

Being within the private care class and its mass premium positioning, Mamaearth enjoys a wholesome gross margin profile of about 65%. This offers the corporate sufficient head-room to put money into advertising (40-50% of income in FY19/ FY20) and ramping up folks’ capabilities.

Given its robust development, Ebitda loss (as a % of income) declined from around 27% in FY19 to around 7% in FY20. As per administration, the corporate turned Ebitda-positive in FY21 and plans are to attain a robust double-digit Ebitda margin within the medium-term, says the Jefferies report.