With rising pollution levels in the world, each country has been scouting for options to cut down on toxic levels, reduce emissions and find a balance between the environment and technology. Recent times have given us one medium to gain this balance, Palladium.

What is Palladium?

Palladium is one of the six metals that fall in the platinum-group category which is mostly used as a catalytic converter in car emissions. The advantage of using this metal is that it works to convert toxic exhausts into simpler forms of water vapour and carbon dioxide. It is more commonly used in gasoline-powered vehicles and is also a byproduct of platinum mining.

The base of procuring Palladium is mostly in Russia and South Africa, from where the major chunk of the world supply of Palladium emerges. Bloomberg data shows how volatile the precious metal is, being in deficit since 2012, seven years, a number that is rare to find otherwise.

Why is Palladium on an increasing graph?

Palladium supply has been tight in the world, mostly due to high demand and shortage of procurement, both events happening at the same time. Moreover, speculators like hedge funds have been making bets on rising Palladium prices and China has been said to stockpile Palladium in recent years.

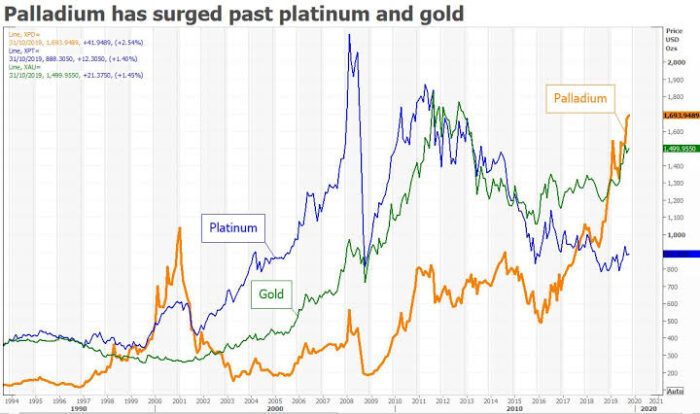

Infact Palladium currently does not have any possible alternative, making it difficult for car manufacturers to cut down on its demand. This has not only made Palladium trade higher than gold but also had palladium-backed traded funds have net outflows.

However, it isn’t uncommon for precious metals like Palladium to face such a spike in prices. In the 1990’s metals like Rhodium rose by 4000% whereas Palladium is not close enough to beat that record.

On an unexpected rise!

Even though many believe that electric cars will reduce the use of Palladium and control its prices, but it is still a doubt as to when in the future, if at all, would electric cars replace standard fuel-run cars.

Hence, as the cost of procuring an important raw material rises for automakers, the cost of purchasing a car for consumers also rises, leading to increase the burden on buyers and price surges. After a point, it would become difficult to sustain such costs and it is crucial that research for substitutes should be prioritized.