Are you a resident of Mumbai or Delhi? If Yes, then do you use an MTNL telephone network? For many, you might have even forgotten the existence of it, but those who still continue to use the network, the time is near to turn to a new network.

Why? Because the government is finally mulling over the option of shutting down the debt-laden firm and monetize its land, buildings and tower business, Mahanagar Telephone Nigam Ltd. (MTNL).

What made the government bring to this decision? Let us know about the whole situation more closely.

What is MTNL all about?

MTNL is a state-owned telecom service company which provides services to Delhi and Mumbai circles. For the past years, the company has been struggling to come out of its problems of declining revenues and huge losses in today’s competitive market.

The tangled debt-trap!

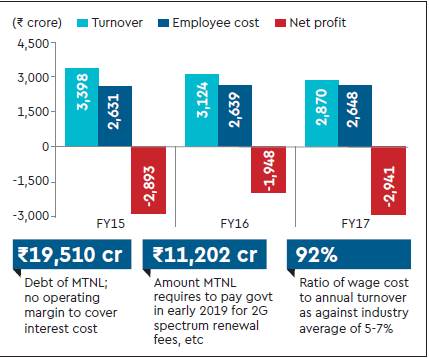

The company is in a debt trap of ₹19,510 crore as on March 31, 2017 (including ₹4,533.97 crore of the bonds, the liability for interest and principle of which are with the Centre).

The Govt. was forced to think over the option of bringing an end to the company services because MTNL’s -year license fee will come up for renewal in April next year, which would require the company to pay an unaffordable ₹11,000 crore.

Evaluation of different possibilities

Different governments explored the possibility of merging MTNL and BSNL and creating one single company but it didn’t turn out to be successful due to HR-related issues. Moreover, even BSNL is incurring losses for the past 5-6 years and is overburdened by a huge workforce.

The list of Assets!

The land and real estate asset of MTNL can be monetized as their ownership rights vests with the company. You will not believe but the company has a total of around 2.5 million sq ft of commercial land and 4 million sq ft of residential assets, spread over the two cities and a large part of these can be monetized either through sale or leasing for commercial purposes.

Also in its annual report for 2016-17, the company was warned because of high leverage and heavy repayment schedule of loans as well as interest payment to banks and financial institutions in the coming years.

The current situation

MTNL has land and buildings at premium locations in Delhi and Mumbai which could provide a huge amount of money if monetized. According to the annual report of MTNL, the gross value of its property, machinery, and equipment were about ₹10,000 crore on March 31, 2017.

There’s only one issue which the company might have to face during shutting down and that is it has a huge staff strength of 27,919 which needs to be taken care of. As far as the firm’s mobile subscribers are concerned, they can easily port out to other operators.

The Government says ‘Close!’

The policy of the current central government, the NDA Govt., is to get rid of non-viable units and invest its insufficient resources on developmental programs. As per the policy, the government is right to think over the closing of MTNL services. Rather, this act of monetizing the assets of the company will be truly appreciated.

Regarding the huge staff strength, they could be shifted to another government telephone services company and the group A officers can be taken care of accordingly.