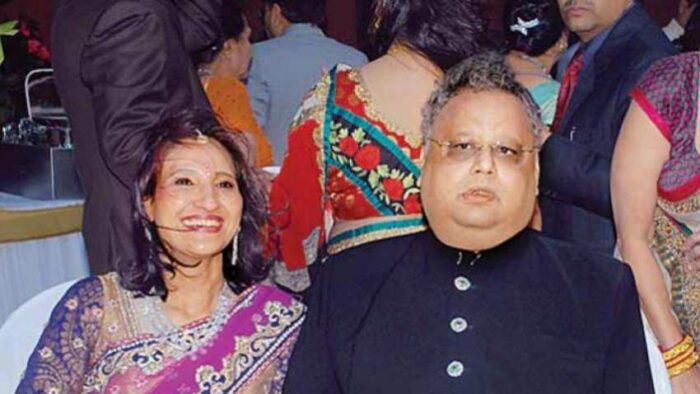

The well-known investor Rakesh Jhunjhunwala, along with his life partner, Rekha Jhunjhunwala earned a jaw-dropping amount of 483.75 crores in just four trading sessions.

The couple collectively is the owner of Titan shares worth RS. 6,968.12 crore currently. The investing icon holds a 5.75% stake while his wife holds a 1.30% stake in the company as on the quarter ending in June 2019.

The unexpected plunge!

On 9 July 2019, the Titan stock plunged 13.14% within a single day and touched a low of Rs 1088.05 as compared to the previous low of Rs 1252.65 after the company acknowledged the fact that its consumption had subsided.

The investors of the company went through a massive loss of Rs 15,000 crore with the market capitalization of the company slackening to Rs. 96,058 crores compared to the Rs 1,11,208 crore on the very previous day.

India’s Warren Buffet!

Rakesh, also referred to as India’s Warren Buffet had bought 6 crores Titan shares at Rs. 3 per share in 2002. The market value of each share is well above Rs 1000 today. The share price of Titan Company was Rs. 1307.5 on September 4. The premium watch company has witnessed an upsurge of 7.46% or 77 points since that day.

Titan was accredited with positive ratings on the commercial paper programme by the rating agency, ICRA. The fixed deposit programme of the company was also phenomenally rated by the ICRA. The agency emphasized Titan’s solid liquidity stature as the reason for assigning positive ratings to the firm.

Here’s what the reports say

According to reports by the ICRA, “Titan’s income exceeds Rs 1,000 crore along with an expected capital expenditure of Rs 300 crore annually. The company has healthy liquid investment of over 900 crores (barring inter-corporate investments) and almost no commitments towards long-term debt repayment” as on 31st March 2019.

The jewellery segment

The agency also pointed out the importance of the company’s jewellery business which has constantly been gaining market power. The revenue from Titan’s jewellery segment has been rising consistently accredited to the strategies regarding wedding and high-value studded ornaments sector.

On top of it, Titan’s growing presence in the low market power countries and the gold exchange program favoring customers are the factors chiefly responsible for the tremendous revenue generated by the jewellery segment.

The ace investor also referred to Titan as his favorite share investment in his recent conversation with the Economic Times and no doubt his favoritism towards the Titan stock has been justified as it turned out to be an insanely profitable investment!