Many brands come up with consumer awareness programs to educate their customers. A good marketing strategy might just do the trick to spread awareness and place their product in the market. Something similar has happened recently with Fi.

Fi is a financial app that comes with an in-built savings bank account and other features that help you know your money, grow your money, and organize your funds.

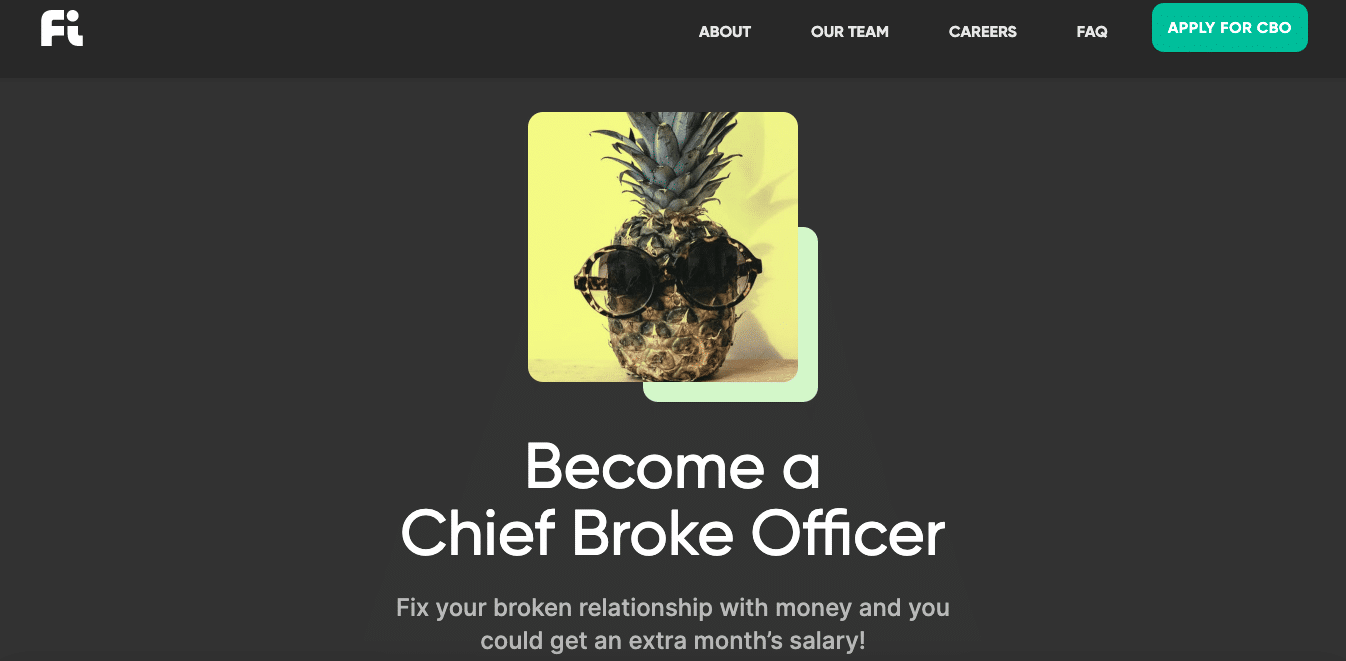

The app has recently rolled out a first-of-its-kind consumer awareness campaign called ‘Chief Broke Officer’ on LinkedIn. Ironically, this job profile for someone who is extremely bad with his or her money-related matters.

The company has explained on its website who should apply for the job. ‘CBO is for working professionals who have a broken relationship with money. So if you make money and generally pay taxes on time, but don’t understand where it went, or what happened to it – you should apply! PS: This is a fictitious role, made to help you get better with money,’ says the ad on the website.

The Ideal Candidate should have the following qualities:

- Skilled in the art of money comes, money goes. Works hard, spends harder.

- Actively procrastinates on all things money. There is always tomorrow.

- Collaborative and hands over money decisions to friends and family.

- Clear about moving to Goa at 40, not clear on how to fund it.

- Supremely confident in not understanding financial jargon or gibberish.

- Working professionals anywhere in India with 1-15 years of experience.

And how will the job help the candidate? Well for starters, it fixes their relationship and gets better with money. Shortlisted candidates will skip the waitlist and get early access to Fi. Additionally, 21 CBOs stand a chance to get an extra month’s salary of up to ₹1 lakh.

Sujith Narayanan, CEO & Cofounder, Fi, said that though all of us like money and how to make money but we do not understand how to manage it and multiply it. In hopes of which ‘we run to our parents, chartered accountants, and anyone else willing to help us with it. We crib every tax season or every time we end up buying a mediocre financial product’, he said.

Unfortunately duct tape can’t fix this, fortunately, you can. Apply for the role of #ChiefBrokeOfficer and fix your relationship with money.

Apply now https://t.co/oUTL9xBkGn pic.twitter.com/DlsGSQ3H6Q— Fi Money (@Bank_on_Fi) March 3, 2021

As per Sujith, the objective of introducing the role of Chief Broke Officer was to call attention to our broken relationship with money.

“For us, it was also a way of introducing our features and waitlist to interested users. An unconventional approach but definitely one that helps both of us. You & Fi. We have received thousands of applications for the role so far and have noticed some interesting conversations on social media around the campaign,” Narayanan said.