What is the Best Way to Practice Copy Trading

Today, anyone can enter gigantic global markets like the currency exchange. Beginners often lack the necessary skills for profit, let alone consistent success. Forex could be your key to financial freedom if you work hard to master it. Fortunately, newbies may delegate decisions to pros. Copy trading is a popular trick offered by regulated brokers in India. Here is how it works.

Delegation of Trading

Members of the global trading community may copy one another thanks to smart brokerage systems. Popular providers have ratings of strategy managers on their sites. These are seasoned traders who are willing to share experience for a fee.

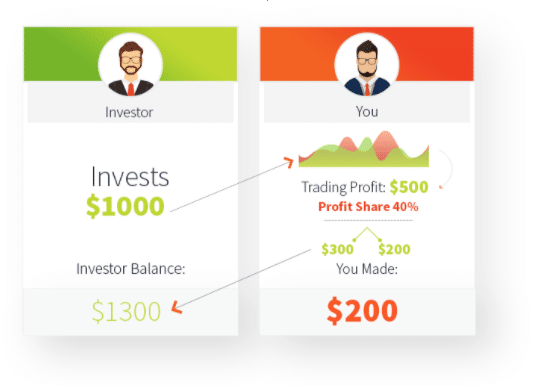

When you choose a candidate and sign up for the service, your accounts are linked. The expert is then trusted with managing a portion of your balance. All of their subsequent actions are replicated in your account as if you were following the same strategy.

In the process, traders may cancel individual positions or terminate the connection altogether. They retain complete control over their accounts. For the strategy manager, the benefit is the fee. If their decisions bring profit, they get a portion of it.

Who Uses Copy Trading

You may suppose beginners are the only ones who copy others. However, this is not true. Contemporary copy trading is a universal tool that is popular with users of all levels. Even experienced traders use it from time to time when they cannot carry out their own analysis. Their forex trading action continues without active participation. All they need to do is monitor the experts’ performance from time to time.

Guaranteed Results?

Foreign exchange is the largest financial market in the world. Transactions between major banks, multinationals, hedge funds, and individuals create a turnover of 5+ trillion US dollars daily. Currency values rise and fall all the time, driven by a plethora of factors.

Therefore, even the most insightful experts may fail from time to time. The hidden mechanics of the market is beyond any trader’s control. Past performance does not guarantee future results.

An experienced trader is more likely to make the right decisions, yet the outcome is not guaranteed. Force majeure events and crises cause market chaos. Copy trading improves the odds of winning but doesn’t give a 100% result.

How to Choose an Expert

Global brokers like Forextime monitor the performance of their strategy managers daily. Their candidates are ranked based on performance and a range of quality indicators. For example, in the FXTM Invest system, clients may filter by return rate, risk tolerance, years in trading, style, etc. They can identify candidates whose approach to strategy and risk matches their own.

After a client chooses their manager, they make a deposit and have the expert’s trades copied automatically. This applies to any positions open at the moment of linking and all subsequent actions. That’s all! When profit is made, the client cashes in, sharing a portion with the manager.

Is Your Broker Legit?

It is tempting to open an account with the first broker you see. Unscrupulous providers advertise copy trading as a guaranteed way to make money. Do not take marketing claims at face value. First, check the background of the company. Trustworthy brokers are officially licensed by monitoring entities like the UK-based FCA, the CySEC in Cyprus, the FSCA in South Africa, etc.

Forex is a popular occupation and a highly competitive field. Due to the abundance of choice, picking the right broker is a challenge. Big international brands serve millions of clients worldwide, have broad collections of industry awards and physical branches in different countries. Their multilingual call centres work 24 hours a day every weekday. Choose wisely to keep scammers at bay.

Final Words

Copy trading is a popular way to make money by proxy. Through online brokers, you may find experts in different markets, but Forex is the default domain. Detailed ratings help you pick the right professional with a similar strategic vision.

As copied traders get a commission, they are incentivized to make a profit. Clients also retain complete control of their accounts. This system benefits traders of all levels, allowing them to save time and see effective methods in action.

Try copy trading today and develop your own competence. In the future, you may become a copied trader yourself! In Forex, sharing of knowledge is an additional source of profit.