Vodafone and Idea have finally merged as a single entity and has become India’s largest telecom player and no. 2 globally. Acquisitions are mergers are always very tricky and looking at the scale of big companies like Idea and Vodafone a lot of new changes are expected.

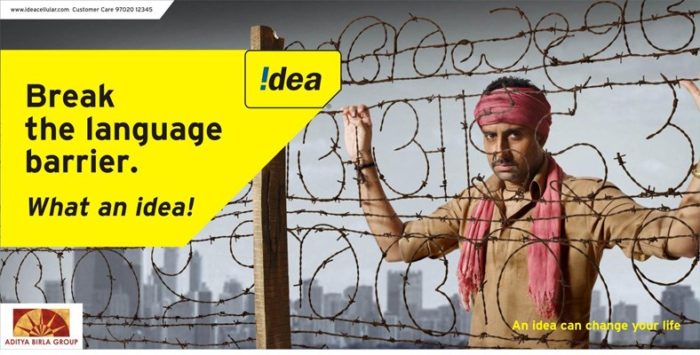

Idea has positioned itself as an empowering and revolutionary brand. With campaigns such as ‘What an Idea Sirji’ Idea attracted the youth of India.

Vodafone, on the other hand, has managed to position itself as a happy to help brand. Vodafone has created some iconic advertising using the Zoozoos and the famous pug.

Also Read: 8 Biggest Mergers And Acquisitions Of 2017

Idea and Vodafone will have a market share of 43% with 408 million subscriber base with a single brand voice given the diverse positionings of both brands currently. Indian Telecom industry is very price sensitive. Airtel after losing its no. 1 position, will come with aggressive advertising and Jio has already shown its intent by the reply on tweets which Idea and Vodafone had posted to raise the popularity of this merger. This is how the conversation went:

Hey, @VodafoneIN you know they're all talking about us.

— Idea (@Idea) August 31, 2018

Yeah @Idea. It's time we made it official.😉🙂 https://t.co/CO5qmSypUc https://t.co/Rvpvn28qYb

— Vodafone (@VodafoneIN) August 31, 2018

Bringing people together since 2016. ❤️@VodafoneIN @Idea #WithLoveFromJio https://t.co/A7iDw6awvK

— Reliance Jio (@reliancejio) August 31, 2018

Jio is used as a secondary SIM currently by users and the company will try its best to convert its customer base permanent.

Things will get more clear after the brand campaign for VIL launches. Ogilvy India is said to be working on the campaign that will launch VIL soon. Along with promoting the new technologies like Mobile payments, IoT, digital wallets, and cloud services, the ads will focus on promoting about providing a better network on 2G, 3G and 4G platforms.

Talking about the merger, Roopak Saluja, Founder and CEO, The 120 Media Collective said in a recent interview: “While the merger is a positive development from a competitive and market dynamics standpoint, make no mistake, it wasn’t conceived through a customer-centric lens. This marriage is first and foremost about cost optimization and increased profitability. I don’t see things changing much for either of the two brands and their advertising, at least for the medium-term if not the long run. They’re both strong brands with iconic advertising and while the new entity can benefit from media-buying and procurement scale, it would only make sense to manage them completely independently. Aside from the obvious network, infrastructure and subscriber advantages that will accrue, the new combined entity will be better poised to deliver on what it means to be a telco in 2020. Investment in technology and content will be key and neither comes cheap, whether organically or inorganically.”

What’s your take on this? Do let us know in the comments section.