Bata is a multinational shoe organisation, which manufactures and retails footwear and fashion accessories, based in Lausanne, Switzerland. It was founded in 1894 and was incorporated in Kolkata in 1931 when it manufactured leather footwear and footwear products and allied to trade.

Since the roots of the company were age-old, it was considered old-fashioned. And to an extent, it was really old-fashioned because it did not make any remarkable innovation according to the changing trends, until recently.

The Turning Point

About a decade ago, Bata was objectified as the School Shoes. This was the sole reason why Bata had a share in the market.

Until now, when Sandeep Kataria took over as the CEO of Bata India in November 2017, R.K. Gupta took over as the CFO, and Alexis Nassard took over as the global CEO in August 2016. These were the three pillars, who played an instrumental role in driving the change at the company.

The Change

Alexis Nassard took the responsibility in changing the vision of the age-old footwear manufacturing hub. He considered India as the most important market place to run its business, which was slowly declining due to the stubborn one direction vision of the company. He considered the tastes of the younger generation and made the shoes more portable to them and on the hind-side also expanded a women’s line of shoes.

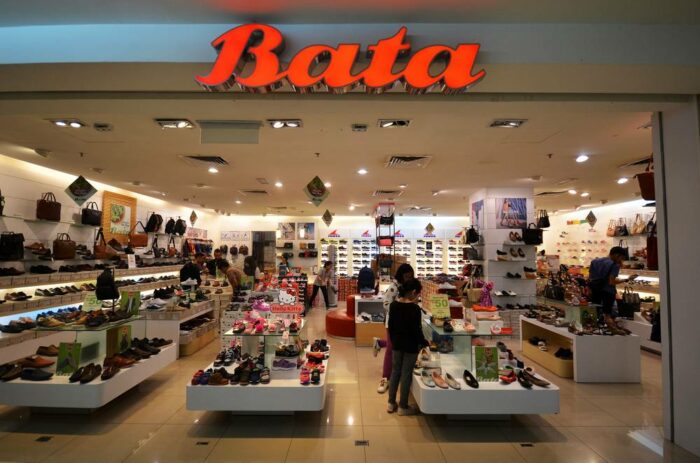

Bata recently introduced new designs and styles, which were in line with the market trends and were well accepted by the public. The special appeal was added when the company starred the young film actors, Sushant Singh and Kriti Sanon, as their brand ambassadors. The company is now selling products across 550 cities through 1400 stores.

Good news for Investors

The faith of the investors was just won over, when the turnaround reflected in the company’s financials. It registered the improvement of margins, with premium footwear accounting for nearly one-third of its sales.

Bata has become a mega wealth creator in the past three years, surging nearly 180 percent gains and more than 3000 percent in the last 10 years.

The Improving Margins

The aids towards the improving margins:

1. The better marketing product mix, with mid-premium and premium contributing about 30 percent of their revenues respectively.

2. Lower input costs, helping Bata to boost gross profit.

3. The cut in the GST from 18 to 5 percent on footwear below Rs. 1000, was an important aid.

4. Controlled rental cost and better operating leverage, also one of the important aids.

The Costliest Brand

Not only Higher than the 5-year average, but also costlier than the other competitors in the league, shares of Bata India is trading at 57 times the estimated earnings in the FY19, making it worthy for investors to put their money on. At the end, ‘Bata Never lets You Down’.